Rapid Reforecasting in the Age of COVID-19

Posted by on May 6, 2020 Chartio

Companies having to reforecast their 2020 numbers are looking for guidance on where to focus and how to present this new reality to key stakeholders. Chartio and 4th & King are here to help. Simply fill out the form at the end of our interview and we’ll be in touch.

The COVID-19 challenge to startups is unprecedented, with the scale of its impact still largely unknown. Companies having to reforecast their 2020 numbers are looking for guidance on where to focus and how to present this new reality to key stakeholders.

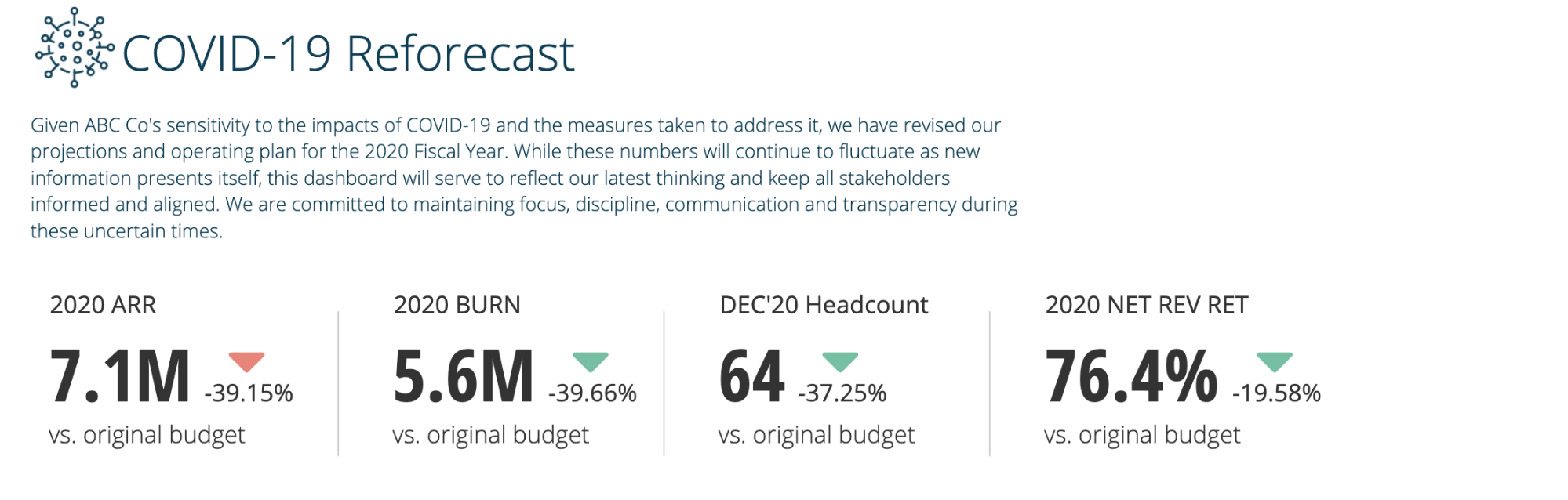

Sheridan Gaenger, Chartio’s VP of Marketing, sat down (virtually) with Amanda Kattan from 4th & King to discuss the impact of the virus on the financial health of the startup community and to learn how business leaders should be addressing this new economic reality. For years, Amanda has been a Finance leader in the startup community and one of Chartio’s most outspoken expert users, and recently she published her COVID-19 dashboard for founders to provide guidance to their key stakeholders.

Sheridan: With volatile valuations and uncertain financial markets, executive teams have been forced to revisit fundamental assumptions about their companies and their plans for the coming quarters. How should they approach this process?

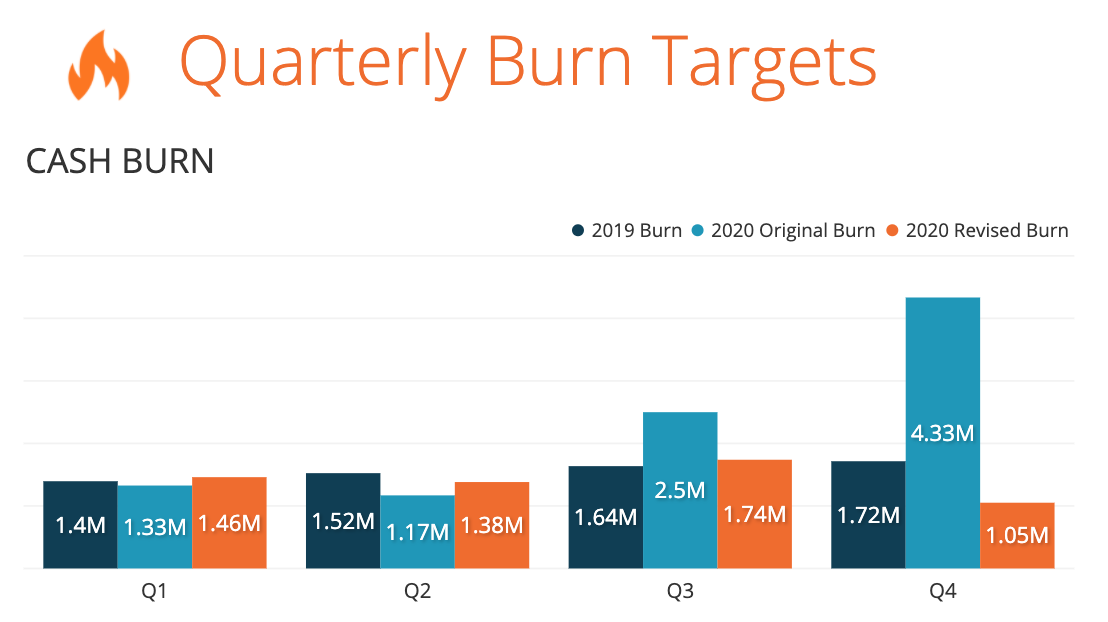

Amanda: Aside from the safety and health of their employees, they first need to start by addressing liquidity concerns. Priority # 1 needs to be ensuring that the lights stay on, particularly if assumptions you’ve made—such as funding operations with future revenue—are now at risk. Review outstanding receivables to understand where there is payment risk. Diligence every expense category and decide where to cut, reduce, or defer. Don’t be afraid to reach out to suppliers, landlords, and partners to see if you can revise existing arrangements. Many of them will be open to creative solutions here: many landlords have substantially reduced or deferred their rents for certain tenants. At 4th & King, we’ve helped several clients navigate this tough process to a successful outcome.

Second, I would reach out to each of your customers individually to understand how the situation has affected them. These might be difficult conversations to have, but being proactive here can earn you a lot of goodwill. Again, there can be room for creative solutions – for example those that are better capitalized might be willing to pay upfront in exchange for a discount. Those that are squeezed for capital might be willing to sign a longer contract with higher escalations in exchange for a payment deferral now. Some customers that have just had their hiring budgets slashed may be able to outsource services to you that they once did in-house. Helping your customer survive a temporary cash crunch can make them loyal for life.

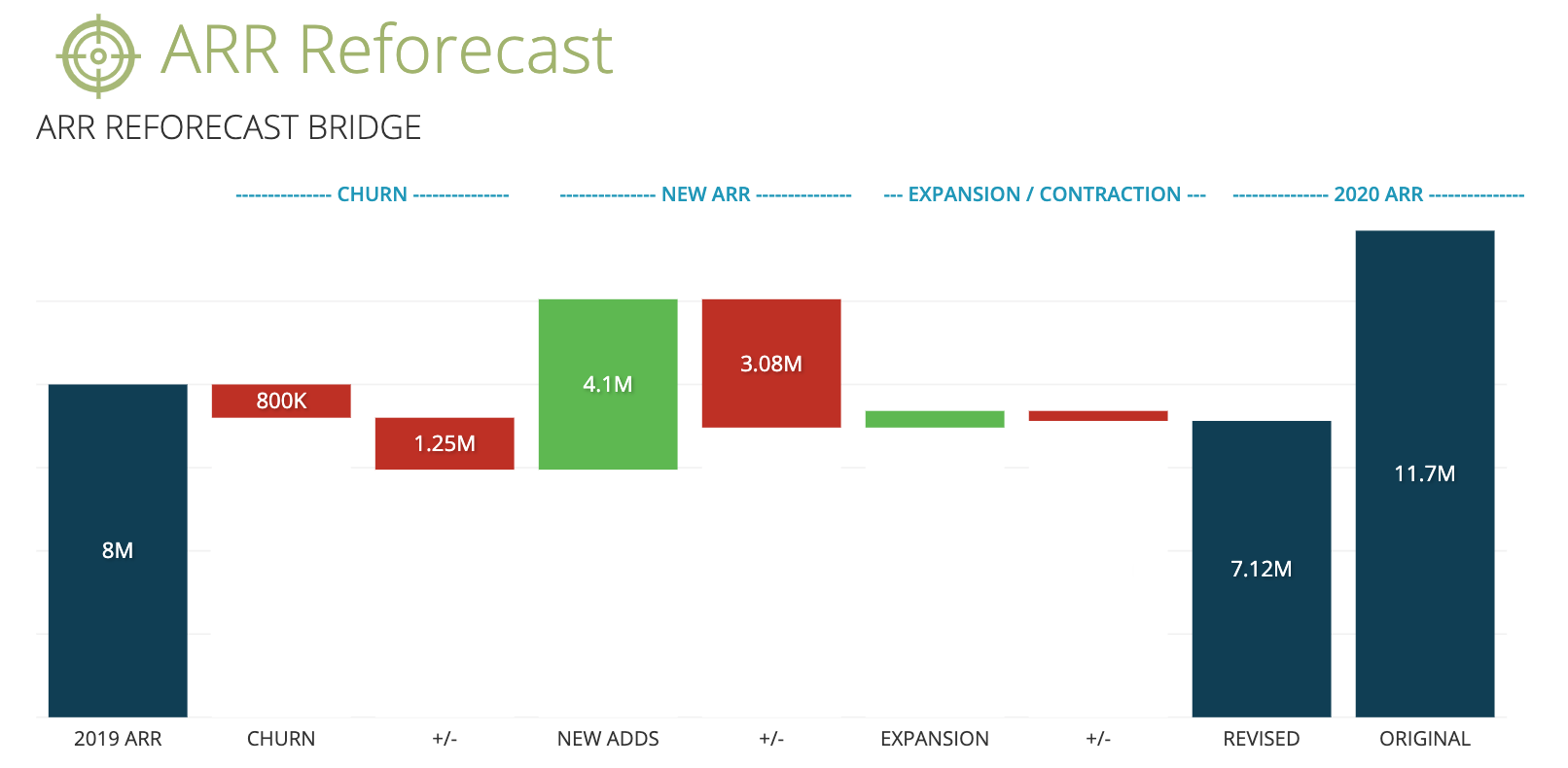

Next, revisit the key assumptions of your business model and take appropriate action now to mitigate unpleasant surprises in the future, while keeping an eye out for new opportunities. Revise headcount plans to reflect softer growth and reduced marketing efficiency. Understand the impact of input cost fluctuations on your unit economics. Assess opportunities to gain market share as clients of competitors are looking for increased service at a reduced cost.

Lastly, this is a time when constant communication is key. Make sure that your team understands what the key drivers of your business’s success are, and how those factors are affected by COVID-19. I recommend having weekly or bi-weekly exec team meetings to keep everyone on the same page as the situation evolves. Aim to strike the right balance between maximizing transparency without over-promising: everyone should understand that the situation remains very fluid and there are many unknowns, so it is likely that any plans you make right now will need to be revised. That’s fine – help your team understand the current plan and the major variables that might cause that plan to be altered.

Sheridan: In most cases, doesn’t an accountant manage reforecasting in Excel? How is Chartio helping in this regard?

Amanda: A BIG EMPHATIC NO. Account managers shouldn’t be managing this process in Excel. Forecasting at the best of times is a collaborative and iterative process. At a time when so many variables are changing at once, with untold secondary and tertiary effects, decisions can’t rely on data that has been stable for decades, or “closing of the books” at month end.

You need self-serve, real-time analytics, not Excel. You need transparency and alignment on objectives and priorities, and you need continuous visibility and access to the most up-to-date information to make decisions. Imagine ordering materials based on last month’s expectations of sales volumes? Customers may be closing their doors, input prices may be skyrocketing or plummeting - you need to be reevaluating your unit economics in real-time. This cannot be done via Excel sheets that become outdated as soon as they leave the outbox.

Through modern BI tools like Chartio, you can have continuously updating variables in real time flowing through every team’s dashboard, with instantaneous go/no go decisions that result.

Sheridan: What’s the most important metric a CEO should be focused on right now?

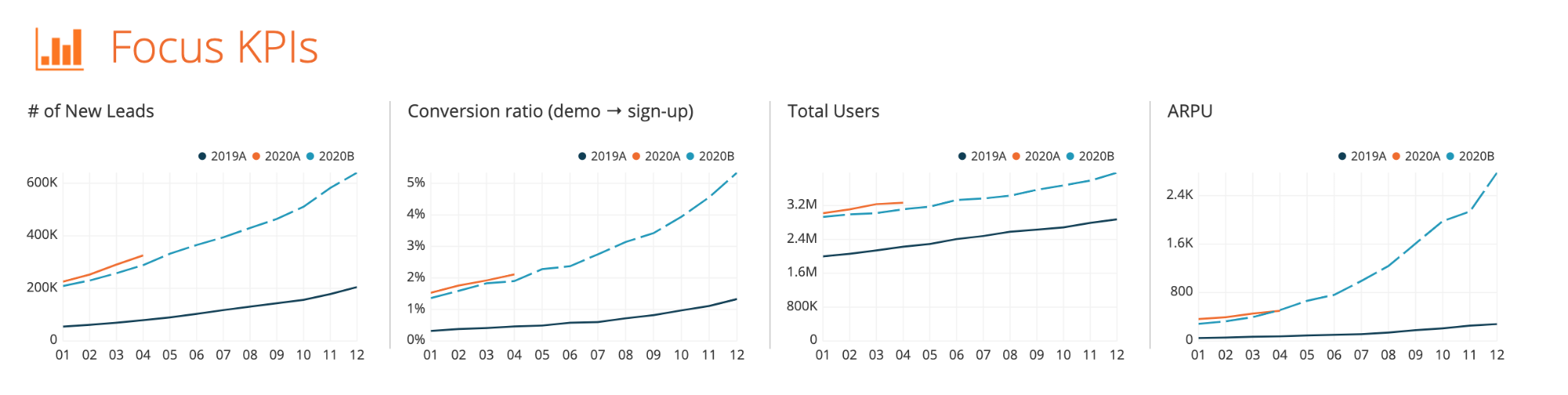

Amanda: In times of greater uncertainty, the focus will be more heavily placed on cash in the door, rather than bookings and future agreements. I recommend getting out of a ‘scarcity mindset’ as quickly as possible so you can get back to building the business. This involves having a super strong handle on cash coming in and cash going out. Cash coming in is the hardest - it involves an intimate understanding of your customers. Cash going out is more in your control — payroll is often the largest component and relatively stable in the short term. Understand the key drivers of every expense and how they will evolve. And remember — cash is a lagging indicator. Make sure to also zealously track leading drivers of growth/contraction - lead generation, close rates, contract values, user expansion, churn.

I suggest revisiting the key assumptions that drive the unit economics of your business and really testing whether or not they hold true in this new era. Don’t wait for bad news — get ahead of your assumptions and revise them downward where necessary.

With so much change that’s out of our control, the focus should not be as much on “pinning down the right number” — rather it’s about understanding the key drivers of your particular business that are most affected, what’s at risk and how you build resilience around that (whether through greater liquidity, extended contracts, creative working capital management…).

Sheridan: Is it all doom and gloom? Any silver linings here?

Amanda: As we’ve learned from past catastrophes - positive change can come from this and we will see a rise to a new generation of great companies. These companies will be more disciplined around pricing, unit economics, and a path to profitability. They will be more focused on their numbers, with data rather than ‘greed and speed’ driving decision making. Growth junkies will give way to stewards of shareholder capital, focused on real economic returns. Teams will be tighter, more aligned and have a more narrow definition of what it means to create value. As Jim Collins put it “In a world of constant change, the fundamentals are more important than ever”.

In a world of constant change, the fundamentals are more important than ever.

–Jim Collins

We’re grateful for the opportunity to work with seasoned domain experts such as Amanda to create a set of fully automated, best-in-class reporting dashboards that our customers can leverage across their internal teams and external stakeholders with minimal effort—they take less than 5 minutes to set up once your data is ready.

Ready to get started? Simply fill out this form and we’ll be in touch.

About 4th & King:

By combining effective storytelling with world-class design, all backed by financial expertise, 4th & King has built a reputation as the leading fundraising agency for top Silicon Valley startups and venture funds, having helped their clients raise over $4.2 billion in funding to-date.

About Amanda Kattan:

Amanda is the head of Strategic Finance and Data Science at 4th & King. With over a decade of investing and operating experience as CFO of multiple high-growth startups, Amanda works with senior leadership teams to leverage data driven decision making and optimize their financial health.