What is a Customer’s Lifetime Value?

A customer’s lifetime value, or LTV, is the measurement of how much a customer is worth to a business over their entire tenure with that business. LTV does not measure just what the customer will spend in a single transaction, but rather what they will continue to spend with a business until they no longer buy anything from the company.

For example, a customer that spends $300 in a single transaction which might appear to be more valuable than a customer who spends $100 in a single transaction. However, if that $100 customer comes back to your business ten times to make future purchases, they have an LTV of $1000, which is more than if the customer who spent $300 never returns.

How to Calculate a Customer’s Lifetime Value

In order to customer lifetime value of a customer, you need to know three key things:

- How much a customer spends in an average purchase with your business

- How often the customer makes those purchases

- The average length of time a customer will remain being a customer of your business

LTV Formula

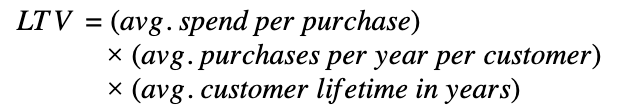

The formula looks like this:

Note: The above formula is based on a yearly period of time, but could also be calculated on any amount of time. So we might compute LTV based on purchases per week and lifetime in weeks, purchases per day and lifetime in days, etc.

Lets step through calculating each piece and then return to and example of the formula.

Average Purchase Amount

Do people always make the same sized purchase when buying from your business? Most likely they do not, but in order to calculate any summary statistic we need to compress the variability of the distribution into a single representative number. When we have data on past customers we can perform an average across all transactions. To get a more sensitive view we can timebox this average to be for purchases within the past year or month. This can also be broken out by cohort if the purchase amount changes significantly over time or between demographics.

Average Number of Purchases

Here again we face the same problem as before – will be people be consistent in their purchasing behavior? Almost certainly not, but we need to make an assumption that it is in order to have a high level view of what is going on. We can timebox this average or use cohorts to tune this number to be more relevant.

Time With Company

There are multiple ways to measure how long a user stays with you. If your company has been around a long time and many customers have established histories of starting and ending their purchases with you, then you can use the average amount of time it took for that to happen for your LTV. Often times it is necessary to create a time window to establish that a customer has stopped buying from you. For instance, you could set a 3 month window that if they have not made a purchase in the past 3 months they are considered churned.

This computation gets much more complicated when you have many customers who currently exceed this average lifespan and are continuing to purchase from your business. How do we predict the length of time these customers will buy from our business? There are several strategies that involve statistical modeling but we will not delve into those. Instead we propose a simple model using the Lindy effect to make an estimate. We discuss this further in the proxy metrics section since it is not an exact formula.

Example LTV Calculation

Customer A spends $125 in an average purchase. Generally, Customer A averages a purchase every six months, and will have an average lifespan of 3 years with your company. Customer A’s lifetime value to your company, then, is $750.

Customer B, on the other hand, spends an average of $75 every 3 months, and will have an average lifespan of 10 years with your company. By contrast, Customer B’s lifetime value to your company is $3,000.

You can use this formula to calculate the lifetime value of all customers, segments of customers, or even individuals. We will discuss how to use proxy metrics to determine the different parts of the formula if the data isn’t available at the end.

Visualizing Lifetime Value

There are many different ways to visualize customer lifetime value, and your choice will depend on the specific aspects of your LTV that you want to emphasize. Let’s explore the most common and most effective ways to visualize LTV:

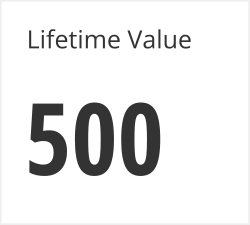

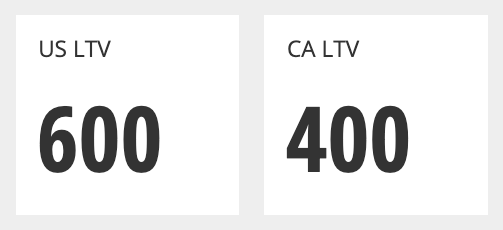

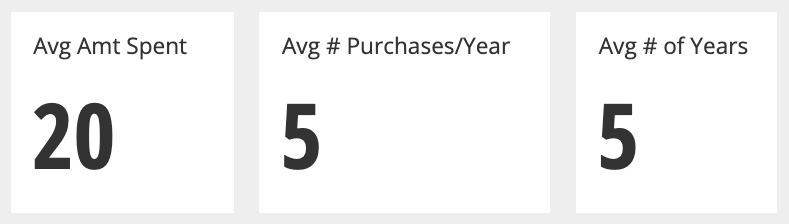

- Single value charts can clearly summarize LTV. You could also use these to show LTV of different customer segments or different parts of the LTV equation.

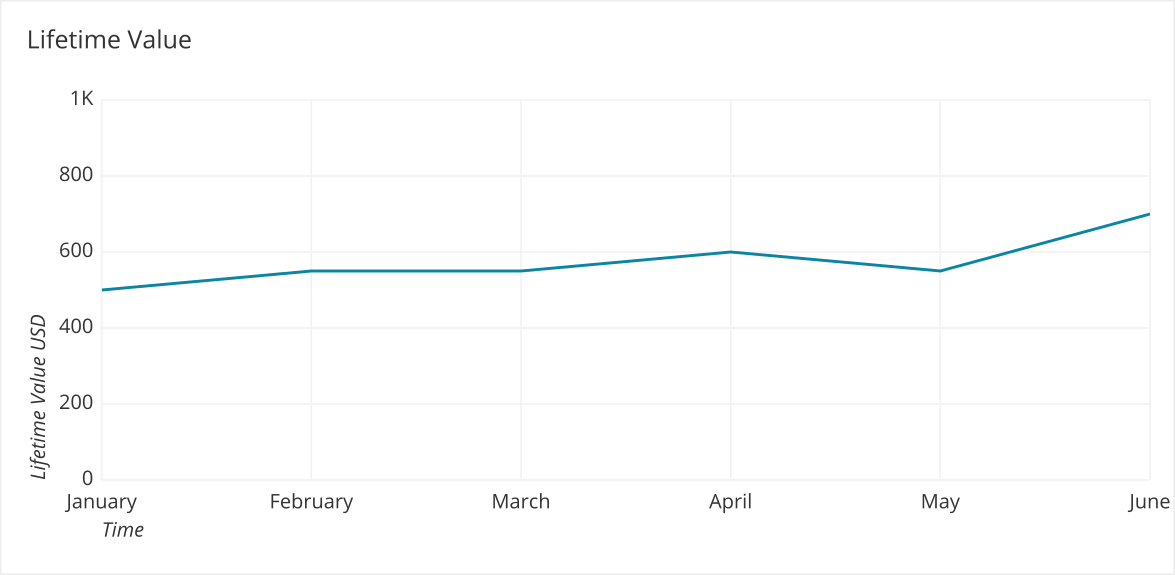

- Line charts can display LTV over time to expose overall trends using moving averages. However, a line chart does not capture which part of the equation may be changing.

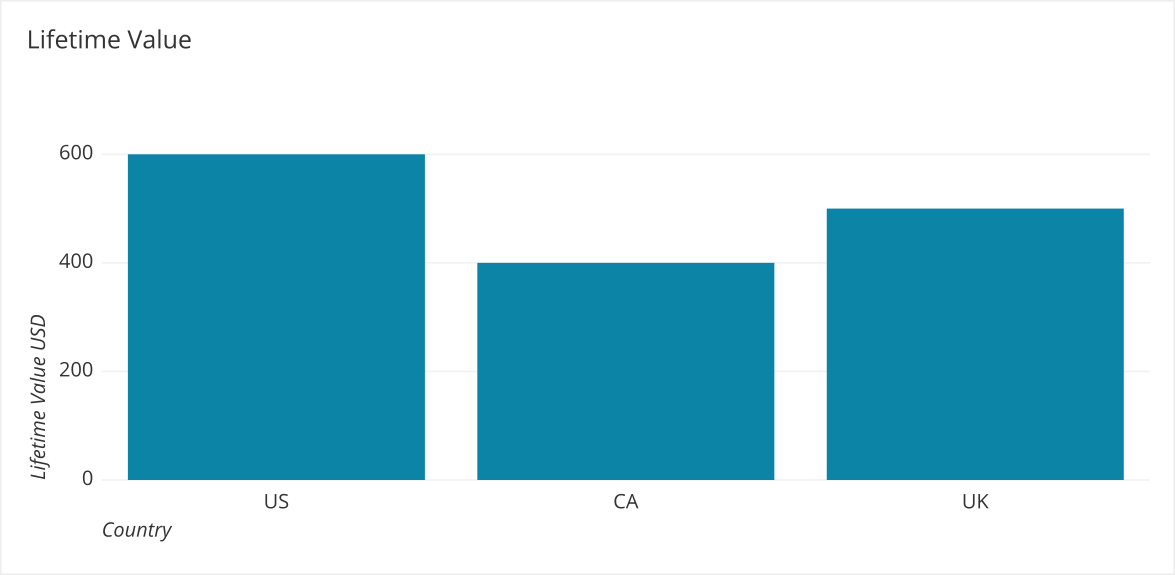

- Bar charts can help you compare the LTV of different categories of customers.

Effectively Using Lifetime Value to Drive Business Decisions

Customers’ lifetime value gives you an upper limit on how much you can spend acquiring and servicing a customer. Keeping an eye on how LTV changes can help you optimize your business. Let’s dig in deeper to the business implications of LTV.

How Much Can You Afford to Spend on Advertising?

If you discover that the average customer’s lifetime value to your company is only $250, you don’t want to spend more than that to attract them to your business in the first place. A LTV to Customer Acquisition (CAC) ratio of 3:1 is considered good in most cases. As LTV grows, the amount you can spend to attract a new customer also increases.

What Is Your Customer Service Worth?

When it comes to spending money on your customers, it doesn’t stop when you bring them in the door: you also need to retain them. Efforts to keep customers can include retargeting campaigns, emails, and even your customer service. These are additional costs to keep in mind that need to be below the customer’s LTV.

What Buyer Persona Represents Your Best Customers?

When you calculate the lifetime value of your customers, don’t look at the customer base as a whole. Instead, break down your customers into different segments. Then evaluate these segments to see if their LTVs are different. Are some routinely spending more or staying with your business longer than another segment? If so, focus on marketing to that specific segment to bring in more of these high-LTV customers in. Alternatively, you might shift your efforts so that you can offer products more likely to appeal to buyers who are currently spending less at your store, encouraging them to make bigger purchases in the future.

Acquire new customers or retain existing customers?

When LTV increases, there is more money to spend on acquiring and serving the customer better. Acquiring new customers does not increase LTV, retaining customers for longer does. It is also typically easier to retain existing customers since you have more opportunities to convince them to stay without needing a paid channel for that communication. To acquire customers it almost always takes more money to get in front of them.

Segmenting Lifetime Value

Customer lifetime value can tell you a great deal about the buying habits of your customers and how much they’re worth. However, we need to dig in deeper to get more value out of it.

Segment Customers

It’s important to segment your customers to understand LTV more fully. Be sure to look at the full distribution behind each segment. If you segment by a demographic without looking at the underlying data you may discover it is not homogenous in their LTVs. As a result, if you de-prioritize this segment you may lose some high value customers.

In addition, make sure that you continue to offer value to all of your customers. You never know when a customer that you perceive as being part of a segment that has less value for your business will have a connection to someone who has greater value or if they might become part of a more valuable segment. Word of mouth is still very relevant and you do not want to treat customers in anyway that would damage your brand.

Segment Equation

While overall LTV of a segment lets us know how much customers are worth we can evaluate the parts of the equation to understand more about how they are interacting with our business. It allows us to ask different questions to drive business decisions:

- Avg. Purchase Amount - Can we increase the money they spend each time?

- Frequency of Purchases - Can we increases the number of times they spend with us?

- Time buying from Company - Can we keep them coming back for longer?

Proxy Metrics for Customer Lifetime Value

Are you struggling to get the numbers you need to measure the lifetime value of a customer with your company? Do you not have enough data to be sure how long the average customer sticks around? Consider:

The Lindy Effect

The lindy effect states that anything that has existed for an amount of time is likely to exist for that same amount of time in the future. If you have had a customer for a year you are likely to retain them for one more year. This is an easy way to predict how long your customers will continue purchasing from your company. While it may not be completely accurate, you can use this until you have real numbers about when customers stop purchasing.

Survey

You can ask customers about purchasing behavior at other complementary businesses. How often do you change SaaS CRM providers? How often do you change project management tools? While this is also not the most accurate it can give you an idea about how long it takes them to re-evaluate the products/services they are buying.

The Bottom Line

Measuring customer lifetime value is a highly effective way to guide your future business decisions. It helps you determine marketing spend, how much customer service you can provide, and where there are opportunities to grow your business with existing customers. Keeping a close eye on how LTV changes over time will help you make better decisions to grow your business.