What Is New Customer Growth Rate?

New customer growth rate is the speed at which you gain new customers over defined periods of time. Growth rate is usually measured with a monthly period. Growth rate measured in this way is commonly referred to as month over month growth.

Calculated correctly, the new customer growth rate helps you understand your overall success in attracting new customers. This product KPI also allows you to understand the nature of the demand for your product, including nuances like seasonal demand shifts.

How to Calculate New Customer Growth Rate

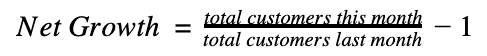

The most basic way to measure the rate at which your customer base grows is to calculate this KPI every month. In that case, the formula is simple:

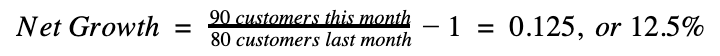

This does not account for churn, the rate at which existing customers leave your company. If you want to measure net growth that includes churn, you can use total customers this month:

Note that it is possible for net growth and new customer growth rate to have different signs depending on churn rate. If you lose more customers than you gain, your new customer growth rate will be positive, but your net growth will be negative.

Example Calculations

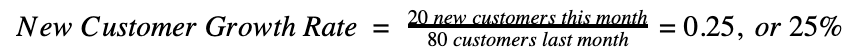

Let’s say that you had 80 customers last month. You added 20 customers this month, and churned 10 customers, resulting in a total of 90 customers this month. In this case, our growth rate and net growth are:

Without Churn:

With Churn:

Average Month over Month Growth Rate

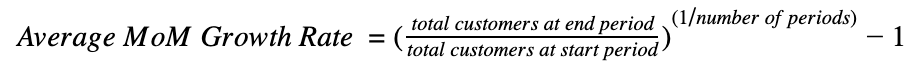

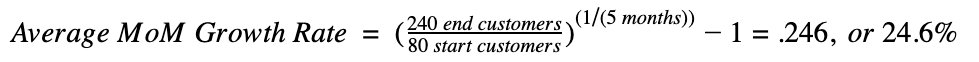

Sometimes, it can make sense to look at the long-term growth rate by looking at the average monthly growth rate over the course of a year. This can remove some of the noise that can come from computing month-over-month (MoM) growth. Alternatively, you might have statistics for year-over-year (YoY) customer acquisition and want to know how that translates down to the average monthly trend. In either case, you can use a formula based off of the idea of exponential growth:

For instance, let’s say that you are looking over a period of five months and have 240 customers this month, compared to 80 customers five months ago. The average month-over-month growth rate for this period is:

In other words, a month-over-month growth of 24.6% over five months has translated into an overall growth of 300%.

Best Practices for Using New Customer Growth Rate

A few best practices help you better understand how to leverage new customer growth rate for true success:

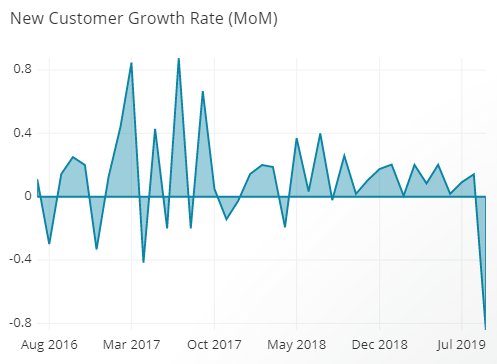

Variability

Compound growth rate helps you discover larger trends in your rate, but should not replace your month-over-month calculations. The more data that is summarized by a statistic the larger chance that you may be ignoring seasonal or periodic variations. Looking at the growth over the past year you may see a 20% growth and think that the growth happened in a steady fashion. However, this summary statistic ignores seasonal trends, where some months are naturally more successful than others, or other similar periodic variations. That growth may have all happened in a short span, with no growth during the rest of the year. Plotting every month in addition to seeing yearly growth rates can help you identify what factors affect growth.

Growth Rates vs Absolute Change

Pay attention to total customer numbers. Naturally, a company with fewer total customers will more easily achieve higher growth rates; 20% growth means only 20 new customers when the origin point was 100, but 200 new customers if that same origin point was 1,000. Even if you add the same number of customers every month, the growth rate slows down because the total number of customers grows: 20 new customers added to 100 is a 20% growth rate, but 20 new customers in the following month will only result in a 16.6% growth rate. Companies often set MoM targets which require more and more absolute sales to happen each month.

How to Visualize New Customer Growth Rate

As with other KPIs, visualization can be a core tool in helping you better understand and analyze your growth rate of new customers.

Single Value Chart

This chart helps you quickly see what your growth rate is in a given time period. It works best when combined with the line graph, which can show an average growth rate across multiple periods.

Line chart

A line chart allows you to plot new customer growth rate or net growth rate over time. This can be a quick way to see if your MoM growth rate is holding steady, increasing, or decreasing by comparing the latest points to previous points on the chart.

Common Misuse of Growth Rate

While growth rate on its own is relatively easy to understand, there are still a number of pitfalls that could prevent you from actually gaining actionable insights into this KPI. The number one problem is failing to filter out test accounts.

There may be times where accounts or customers are created that should not be counted in your growth metrics. Often times employees at your company will sign up for your app or visit your website to test a feature. As another example, support reps might need to solve customer issues by deleting accounts and having them sign up again. If events like these are not properly filtered out it will make the growth rate look larger than it is.

Variations on New Customer Growth Rate

In some cases, changing the criteria you are analyzing can help you gain a better picture of the data you are trying to gather. If you want to understand demand patterns more closely, changing the time period for measuring growth from across months to weeks may show you variations in beginning-of-month to end-of-month demand. In the other direction, changing the time period to quarters instead of months helps you gain a broader view of your company’s overall health.

Compare growth rates of new customers with your revenue growth and determine potential patterns or variations within that comparison. New customer growth that does not result in an appropriate revenue growth may expose growth opportunities or potential problem areas that need addressing. Secondary metrics like average order amount (or revenue per new customer) can allow you to draw similar conclusions.

Proxy Metrics for Growth Rate

Measuring the rate at which your organization gains new customers is important to understand overall business growth, but it’s not the only metric that can help you accomplish that feat. We can also use revenue growth rate, which provides an indication that this business is growing while the number of customers may remain flat or be declining. This metric is especially useful for cash businesses or other types of retail where it is difficult to keep track of your purchasers.

Tools for Measuring New Customer Growth Rate

Growth rate calculations tend to be simple and can be done with a calculator or spreadsheet. Investopedia offers a compound growth rate calculator that only requires the number of customers at the beginning and end of the recorded time frame and the number of periods in the timeframe. It uses the same formula outlined above in the calculation section.

A more complex process lies in visualizing new customer growth rate, especially if you don’t want to or have the time to manually plot each data point on your line graph. That’s where a tool like Chartio, which builds interactive charts based on background calculations, can be helpful. With an appropriate data source, it is easy to compute and visualize growth rate and other vital metrics over the time periods that are most relevant to your goals.