The Only Three Churn Calculations You Need to Know

Posted by on August 5, 2015 Business Intelligence, Data Analytics

Churn is the scourge of the Saas businesses. It’s the flip side of the fast-growth economics of subscription businesses. Unchecked, it can turn a thriving SaaS business into a leaky bucket that’s impossible to fill.

SaaS businesses that fail to address churn suffer debilitating consequences: lower customer lifetime value, reduced attractiveness to investors, and doubts about their future viability.

It’s essential to measure, monitor, and reduce churn. But, churn terminology in SaaS often lacks clarity – or even common definitions.

Outside of SaaS, key metrics have universally agreed upon terminology, promote apples-to-apples comparisons, and govern how narratives unfold for particular verticals. SaaS needs this shared meaning to allow stakeholder conversations to thrive, evolve, and generate true insight.

This short guide aims bring us closer to a shared idea of how to think about churn.

Churn Happens Over Time

Whenever someone tells you a churn rate, make sure they include the period of time over which it is measured. Churn rates are measured for specific time periods

Time is often the reason that churn is miscalculated, not fully understood, or difficult for some to compare fairly.

If someone tells you they have 5% subscription churn, they haven’t told you anything. That’s a goo d annual churn rate, but a bad monthly rate.

Churn rates vary based on business models, contractual obligations, and customer sentiment. If a business is growing quickly, its annual churn rate may not reflect current conditions as accurately as its monthly churn rate.

The other time dimension is the trend of a company’s churn rate. Even an excellent churn rate may be an issue if it is steadily growing. It doesn’t take long for a worsening churn rate to become a serious problem.

Keep these factors in mind as we take analyze the varieties of churn.

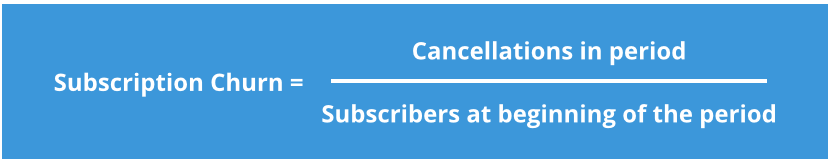

Subscription Churn

Subscription churn is the percentage of total customers who choose to stop using your service during a period. It’s also known in the SaaS industry as logo or customer churn. The number of quitters during the period is straightforward. Divide by the number of subscribers at the beginning of the period, which is the pool they’re leaving, not the number at the end of the period.

Subscription churn is closely tied to customer satisfaction. Not surprisingly, it’s also the primary driver of Net Revenue Churn. We addressed how to use Net Promoter Scores to monitor customer satisfaction in an earlier post.

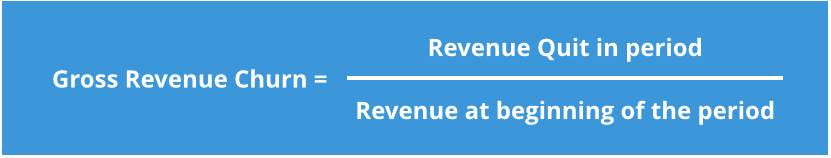

Gross Revenue Churn

Gross revenue churn is the percentage of your revenue that is lost during a period due to customers canceling or downgrading.

Remember that your smaller customers are likely to churn more frequently than your largest customers. Your smaller users may not be fully committed to your offering, are more financially sensitive, and are more likely to go out of business.

Because gross revenue churn comes smaller-than-average customers, it’s typically lower than subscription churn.

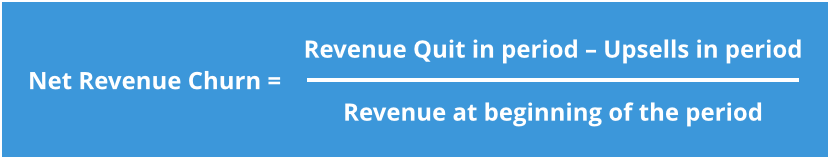

Net Revenue Churn

Net revenue churn is a critical indicator of the health of a SaaS business.

Net revenue churn is the percentage of revenue you have lost from existing customers in a period. To calculate net revenue churn, divide net revenue lost from existing customer in a period by total revenue at the beginning of a period. Net revenue lost is the difference of revenue lost from subscription churn minus new revenue from existing customers (i.e. upsells).

Like all churn metrics, net revenue churn is a percentage, it benefits or suffers from compound interest, so that even small differences in net revenue churn result in large differences in actual revenue at the end of the quarter.

Net revenue churn can be confusing, because positive numbers are bad and negative numbers are good. A strongly negative net revenue churn means that a company’s revenue would increase even if there were no new sales. If net revenue churn is near zero, then churn erases the growth from upsells, so all growth must come from new customers . If it’s positive, the company’s sales team is working hard to fill a leaky bucket.

Minimize the Number of Churn Measures

Be careful when someone strays beyond well-understood metrics and tries to get your to use his own yardstick. Standard metrics provide a common understanding of the dynamics of a business, minimize confusion, and make it harder to obfuscate.

So, while there may be good reasons for introducing new metrics to reflect key performance indicators or to explain a revolutionary business model, complexity is the enemy of clarity. Alternative metrics increase complexity and lower transparency.

Therefore, transparency is a prerequisite to beating back complexity and providing the SaaS industry with a collection of universally understood churn metrics.

We don’t recommend using them, but let’s take a look at some less-common measures of churn that you might encounter.

Expansion Revenue

Expansion revenue is the amount of revenue you are receiving from existing customers who are expanding their engagement with your product from upsells, cross-sells, or premium offerings.

But, Net Revenue Churn already includes expansion revenue (net of revenue lost to churn) in its calculation. So, expansion revenue is all good news.

Negative Churn

Negative churn is simply one of the possible states of net revenue churn, which can be negative or positive. Negative churn simply means that your net revenue churn is negative, or that your expansion revenue exceeds your gross revenue churn. Rather than speaking of negative revenue churn, it’s more correct to say whether your net revenue churn number is negative or positive.

Like medical tests, this is one of those confusing cases where “negative” means good, and “positive” means bad.

Attrition Rate

Attrition rate is just another word for subscription churn. Stick with subscription churn.

Keep it Simple and Avoid Obfuscation

Everyone has ideas about how to lower or slow churn. A lot of those ideas come with new definitions and measures. We recommend you master the standard terminology and focus on the common understanding of these terms before straying too far.

When you set up your dashboards, and measure your KPIs, and set up your incentive systems, keep your eye on churn.

Mature industries benefit from a set of precisely defined terms and metrics. Establishing greater clarity will help us better understand one another and free us from talking about churn terminology to focus on reducing it.

Dave Fowler is the CEO of Chartio.